Monetary Policy Risk: Rules versus Discretion

Monetary Policy Risk: Rules versus Discretion

By , forthcoming at The Review of Financial Studies.

Long-run asset pricing restrictions in a macro term structure model identify discretionary monetary policy separately from a policy rule. We find that policy discretion is an important contributor to aggregate risk. In addition, discretionary easing coincides with good news about the macroeconomy in the form of lower inflation, higher output growth, and lower risk premiums on short-term nominal bonds. However, it also coincides with bad news about long-term financial conditions in the form of higher risk premiums on long-term nominal bonds. Shocks to the rule correlate with changes in the yield curve’s level. Shocks to discretion correlate with changes in its slope. Check it out!

Blog: Should we fear the return of inflation?

Blog: Should we fear the return of inflation?

With the economic recovery, prices started to rise again in the United States, fueling fears of inflationary spirals. An important component in this potential return is household consumption. This should not contribute to the return of such a spiral, believes Eric Mengus, associate professor at HEC. (article in french) Check it out!

Paper: Asset Dissemination Through Dealer Markets.

Paper: Asset Dissemination Through Dealer Markets.

By Jean-Edouard Colliard and Gabrielle Demange, forthcoming at Management Science. Money markets and fixed income markets are typically over-the-counter. Recent empirical research has documented the complexity of intermediation patterns on these markets, in particular the possibility that a large initial quantity is gradually distributed to new investors after a series of interdealer transactions. This paper proposes a model of this dissemination process, and rationalizes some of intermediation structures observed in different markets. The model applies in particular to repo markets and generates an endogenous level of rehypothecation. Check it out!

Blog: Can Housing Prices Fuel Optimism On The Way Out?

Blog: Can Housing Prices Fuel Optimism On The Way Out?

With the advent of the crisis, prices started climbing quickly, reaching a double-digit growth at the end of 2020. Despite it might be too early to comprehend this puzzling dynamics fully, most commentators indicate that as an early sign of recovery, spreading optimism. But, to which extent this may be hint of the way out? Based on his recent publication coauthored with Boston College Professor Ryan Chahrour, HEC Paris Professor Gaetano Gaballo explains how housing prices generates waves of optimism and pessimism causing sizeable fluctuations in the business cycle. A spike in housing prices can then effectively fuel the optimism needed to trigger a quick, persistent recovery of the US economy. Check it out!

Conference: ECB Annual conference on money markets.

Conference: ECB Annual conference on money markets.

The annual conference on money markets organized by the ECB took place on 23 and 24 November. Check out the program and the recording of the presentations here. Jean-Edouard Colliard discussed the paper “Monetary Policy Transmission in Segmented Markets” by Jens Eisenschmidt (European Central Bank), Yiming Ma (Columbia Business School), and Anthony Lee Zhang (University of Chicago Booth School of Business). The paper shows that dealers have significant market power in the over-the-counter segment of the European repo market, and that this considerably attenuates the pass-through of monetary policy changes to short-term repo rates. This paper and others on the conference program illustrate the relevance of combining expertise on market microstructure with monetary policy topics.

Paper: Learning from House Prices: Amplification and Business Fluctuations.

Paper: Learning from House Prices: Amplification and Business Fluctuations.

By Ryan Chahrour and Gaetano Gaballo, forthcoming at The Review of Economic Studies.

People easily observe prices, but not the volume of market transactions shaping them. Thus prices are not only what people need to pay to buy goods, but also signals about underlying changes in economic activity. Important prices for people's life, like house prices, may therefore have a pivotal role in affecting people's expectation on future growth, adding momentum to business cycles. In this paper we formalize this idea and show that even tiny supply shocks may propagate in large demand-driven business fluctuations. Moreover, we demonstrate that these effects do not rely on suboptimal conduct of monetary policy. Check it out!

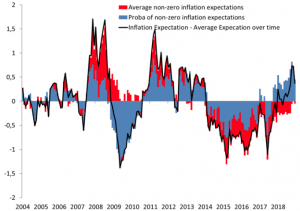

Blog: How households’ inflation expectations matter.

Blog: How households’ inflation expectations matter.

By Philippe Andrade, Erwan Gautier, Eric Mengus. According to macroeconomic theory, managing inflation expectations is crucial for stabilising the economy. This is particularly true in times of crisis, when the nominal interest rate hits its lower bound. This column provides new evidence from France on how the inflation expectation channel operates in terms of consumer spending. The results suggest that households make consumption decisions based on the broad inflation regime that they expect, rather than with regards to the precise inflation forecast. Check it out.

Working Paper: Aggregate Risk or Aggregate Uncertainty: Evidence from UK Households

Working Paper: Aggregate Risk or Aggregate Uncertainty: Evidence from UK Households

In the paper “Aggregate Risk or Aggregate Uncertainty: Evidence from UK Households” Luigi Paciello and Claudio Michelacci find that there is a strong negative correlation between individual household preferences and expectations: households who report to prefer lower inflation, actually expect higher inflation than the average. And this behavior is in part explained by wealth. Richer households prefer tighter monetary policy and higher real interest rates but behave robustly and expect relatively higher inflation at times of higher uncertainty. By overweighting the scenarios that are more unfavorable, households tend reduce individual demand. And lower demand typically translates into lower aggregate output in modern economies. Check it out!

Call: PhD openings at HEC Paris!

Call: PhD openings at HEC Paris!

Are you interested in a PhD in Monetary Economics broadly defined? The faculty at the department of Finance and Economics and Decision Sciences offer supervision in large spectrum of topics including Business Cycles, Financial Regulation, Central Banking, Asset Pricing, etc ... get in touch to know more!